Elon Musk’s SpaceX has once again grabbed the global spotlight. Reports confirm that the tech mogul is in advanced negotiations with the Italian government for a €1.6 billion ($1.65 billion) deal involving Starlink, SpaceX’s satellite-based internet service. While this deal promises innovation and progress, it has sparked fierce debates over national security, global competition, and the implications of Musk’s growing influence.

Starlink: A Technological Revolution

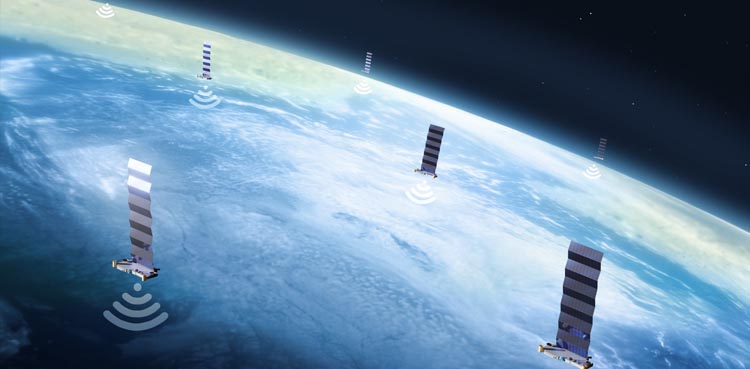

Starlink, a brainchild of SpaceX, has become synonymous with cutting-edge satellite internet. With close to 7,000 satellites in low Earth orbit, the service provides high-speed internet to businesses, consumers, and even national governments worldwide.

The technology is particularly valuable for its encrypted telecommunications, which appeal to military and intelligence agencies. Starlink’s sibling service, Starshield, is already being utilized by the U.S. Department of Defense and has proven indispensable in Ukraine, enabling communication during the ongoing conflict with Russia.

Independent space policy scholar Namrata Goswami believes deals like the one with Italy will become increasingly common as nations recognize Starlink’s unparalleled global reach and secure capabilities.

The Italian Connection

The Italian government has confirmed ongoing talks with SpaceX but has faced backlash from opposition politicians. Critics argue that such a deal could compromise Italy’s national security, placing critical communication systems under the control of a foreign company.

Prime Minister Giorgia Meloni, who recently met with U.S. President-elect Donald Trump, denied allegations that the Starlink deal was discussed during her visit. However, her close ties with Musk and Trump have fueled skepticism.

If finalized, the deal would mark a significant milestone: SpaceX’s entry into providing secure communications to a major EU government. It also raises questions about Europe’s own space ambitions.

A Clash with Europe’s Space Strategy?

The European Union is not sitting idle in the face of SpaceX’s growing dominance. Last month, the European Commission announced IRIS², a plan to launch 260 satellites by 2030 to ensure secure, sovereign telecommunications for EU member states.

While EU governments aren’t obligated to use IRIS², the initiative is seen as a counterbalance to private providers like Starlink. Italy, a major player in IRIS², is now walking a fine line. Pursuing a deal with Starlink could clash with its commitment to the EU’s collective space strategy.

An EU spokesperson emphasized Italy’s sovereignty in making such decisions but pointed out the country’s integral role in IRIS², including hosting one of its three control centers.

The Rise of Elon Musk in the Satellite Sector

Elon Musk’s success with SpaceX has revolutionized the satellite industry. The company’s reusable rocket technology has significantly reduced launch costs, allowing it to deploy thousands of satellites efficiently.

SpaceX’s Starship, a massive reusable rocket with heavy-lift capabilities, could further widen the gap between Musk’s enterprise and competitors. If successful, Starship would enable even larger-scale satellite deployment, solidifying SpaceX’s dominance in low Earth orbit.

Emerging Competition: China and India

While SpaceX leads the race, it isn’t without competition. Both China and India are aggressively developing satellite systems that could rival Starlink. These nations aim to offer cheaper alternatives, particularly to developing countries seeking reliable and affordable internet services. China has already launched its Guowang satellite network, while India’s Bharti-backed OneWeb is rapidly expanding its presence in the satellite communications sector.

Namrata Goswami notes that as these countries advance their technologies, they could pose a serious challenge to SpaceX’s dominance. “If India and China catch up, they will offer what they see as more viable and cost-effective solutions for emerging markets,” she explains.